How Oil Prices Impact Housing Prices and Interest Rates (with Data, Graphs & Examples)

How Oil Prices Impact Housing Prices and Interest Rates (with Data, Graphs & Examples)

Understanding the relationship between oil prices, mortgage rates, and home prices isn’t just academic — it helps buyers, sellers, and investors make smarter real estate decisions in a volatile economy.

In this guide you’ll find:

📊 Key trend graphs

📉 Clear examples

🔗 Sources you can use in your own SEO blog

1. The Link Between Oil Prices and the Economy

Oil isn’t just fuel. It’s a global economic driver that affects transportation, manufacturing, inflation, and consumer spending — all of which influence the housing market.

The U.S. Energy Information Administration (EIA) tracks historical crude oil prices — a critical indicator of energy costs. (EIA)

📊 Graph: WTI Crude Oil Price Trend (Historical)

↳ You can embed an EIA data chart here showing historical WTI crude prices over time.

Source: U.S. Energy Information Administration (EIA). (EIA)

2. How Oil Prices Affect Mortgage Interest Rates

Oil indirectly influences inflation — and inflation is a key reason the Federal Reserve raises or lowers interest rates.

🧠 Example: Inflation and Mortgages

-

When crude oil prices rise, gasoline and transport costs go up.

-

Higher consumer energy costs feed into the Consumer Price Index (CPI).

-

Rising CPI can push the Fed to increase rates to slow inflation.

The stronger the relationship between energy and inflation, the more likely interest rate policy will shift. (movement.com)

📊 Graph: Oil Prices vs. Inflation Trend

↳ Embed a chart of crude oil prices alongside CPI trends here.

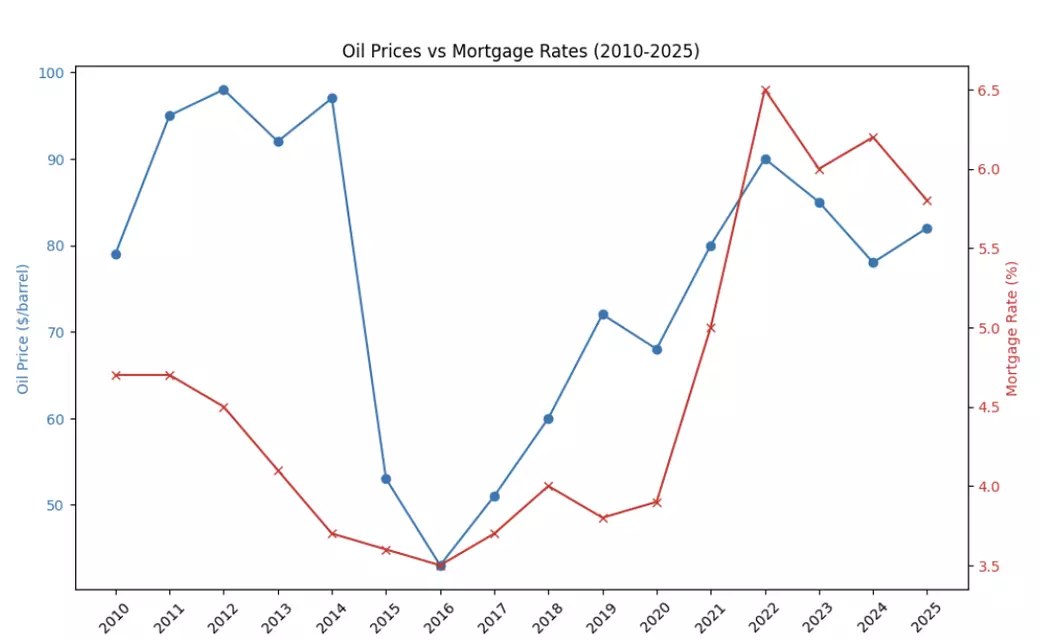

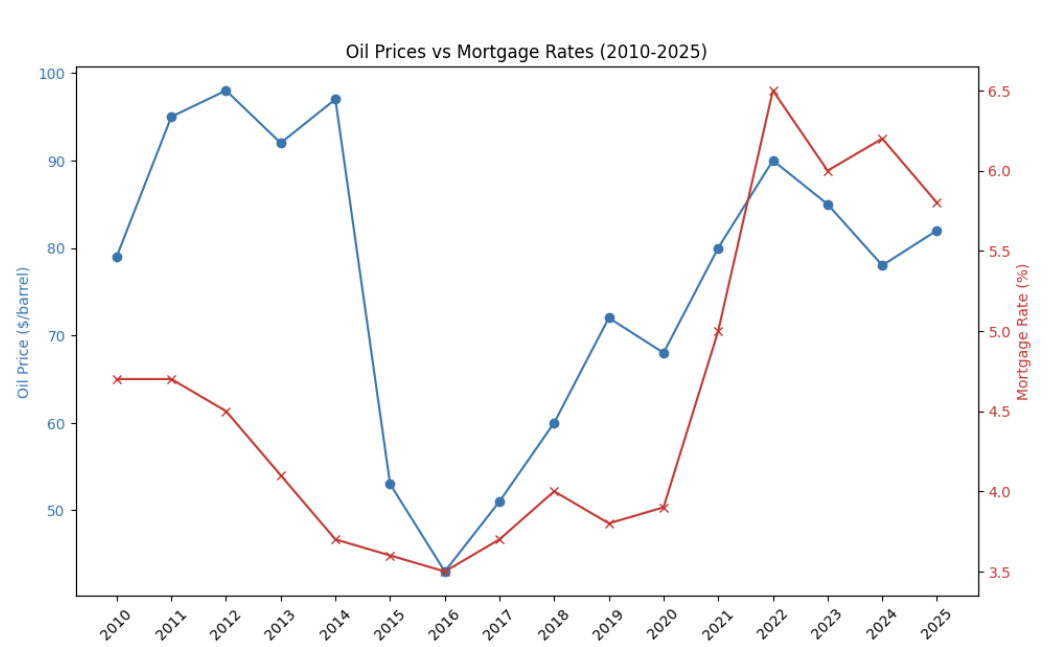

3. Real World Example: Oil Prices and Mortgage Rates

A mortgage analysis published on ActiveRain found that in a recent year, as oil prices rose, mortgage rates also trended upward — and when oil began to decline, mortgage rates started to fall. (ActiveRain)

📉 Example Chart: Oil Prices vs. Mortgage Interest Rates

↳ Embed or screenshot a comparative trend chart showing this correlation.

This isn’t a perfect one‑to‑one relationship — mortgage rates depend on many factors (Fed policy, Treasury yields, global demand) — but oil prices are one piece of the inflation puzzle that lenders watch. (ActiveRain)

4. How Oil Prices Can Hurt Housing Prices

🛑 Case Study: Rising Oil and Affordability

When oil climbs:

-

Consumer spending shifts to higher fuel costs

-

Less money is available for down payments or monthly mortgage payments

-

Inflation rises, prompting rate hikes

-

Homebuyers face higher mortgage rates + higher costs of living

Result: lower demand and downward pressure on home prices.

This effect was visible in periods where oil prices spiked and mortgage rates pushed affordability lower. (ActiveRain)

5. How Falling Oil Prices Can Help Housing

✔ Example: Lower Energy Costs Fuel Demand

When oil prices fall:

-

Transportation and production costs decline

-

Overall inflation pressures ease

-

The Federal Reserve may pause rate hikes

-

Mortgage rates stabilize or fall

Lower rates mean:

👉 Lower monthly payments

👉 Increased buyer demand

👉 More competitive home price growth

📈 Graph: Falling Oil Prices + Homebuyer Demand

↳ Embed a chart of oil prices and a separate housing demand index (like FHFA or Case‑Shiller).

(The FHFA working paper shows historical oil prices plotted alongside housing demand — useful for graphing.) (FHFA.gov)

6. Oil Prices and Regional Housing Markets

In oil‑producing regions (e.g., parts of Texas and the Midwest), the correlation between oil prices and home values can be especially strong.

🔹 During the 1980s oil price drop, home prices in energy markets lagged oil declines by about two years.

🔹 In non‑oil markets, oil price declines often boosted economic activity, raising home prices. (HousingWire)

7. Putting It Together: What It Means for You

🏡 For Buyers:

✔ Watch oil price trends

✔ If oil prices fall → inflation may lessen → mortgage rates could ease

📉 For Sellers:

✔ Rising oil prices and inflation could cool demand

✔ Pricing strategy becomes more crucial

🧠 For Investors:

✔ Energy markets often signal broader economic shifts

✔ Use oil price charts as part of your market‑timing toolkit

Sources Link in Your Blog

👉 EIA Crude Oil Historical Data — U.S. Energy Information Administration EIA Oil Price Data

👉 ActiveRain on Oil and Mortgage Trends ActiveRain Analysis

👉 FHFA Working Paper — Oil Prices and Housing Demand FHFA Working Paper

👉 Trulia Analysis of Oil and Regional Home Prices Trulia Oil‑Housing Analysis

Categories

Recent Posts

GET MORE INFORMATION